What is identity resolution?

Also known as entity resolution or record linkage identity resolution is a critical part of the modern fraud prevention stack.

Fraudsters sign-up with multiple accounts?

- Fraudsters attempt to create multiple accounts

- The connections between them are non-obvious

- Incoming data cannot be processed in real-time

- Fraud prevention ML models run on partial data

This is what happens when an online business lacks robust identity resolution in its fraud stack.

Why is identity resolution crucial for fraud prevention?

Small changes in customer data makes it difficult for machines to make the connection between customer accounts. Real-time fuzzy matching on high-volume is a major challenge for data teams in fraud prevention departments.

Link detection

Fraudsters repeatedly sign-up to your platform, but you are unable to quickly make the connections to keep them out.

Scaling problems

Managing highly-linked high-volume data for fraud prevention is expensive and a strain for conventional data infrastructure technologies.

Manual effort

Teams of analysts are often employed to manually investigate possible account connections costing both time and money.

Imagine if your fraud prevention ML models could run on complete, linked datasets, no matter the volume.

Machine learning models need complete data to make the best fraud prevention decisions.

Graph databases, data warehouses and search technologies are unable to match data in real-time to provide complete datasets for fraud detection.

What you need is a high-perfomance identity resolution solution that is designed for high volume, real-time data.

Supported by leading investors

Say goodbye to unlinked data.

Say hello to Tilores.

Faster than the blink of an eye

Consistent <150ms response times. No matter how complicated the data gets. Perfect for real-time use cases.

Unlimited scalability

Designed for serverless technology, there is no limit to the amount of data that you can simultaneously process with Tilores.

Real-time record linkage

Ingest data in real-time and search simultaneously. Your data is always up-to date and immediately accessible.

Your game, your rules

Fully customizable data scheme and matching rules. The only limit is your imagination with Tilores.

Data compliance by design

Track data provenance and delete data automatically based on rules. Data privacy compliance out-the-box.

Identity resolution the easy way

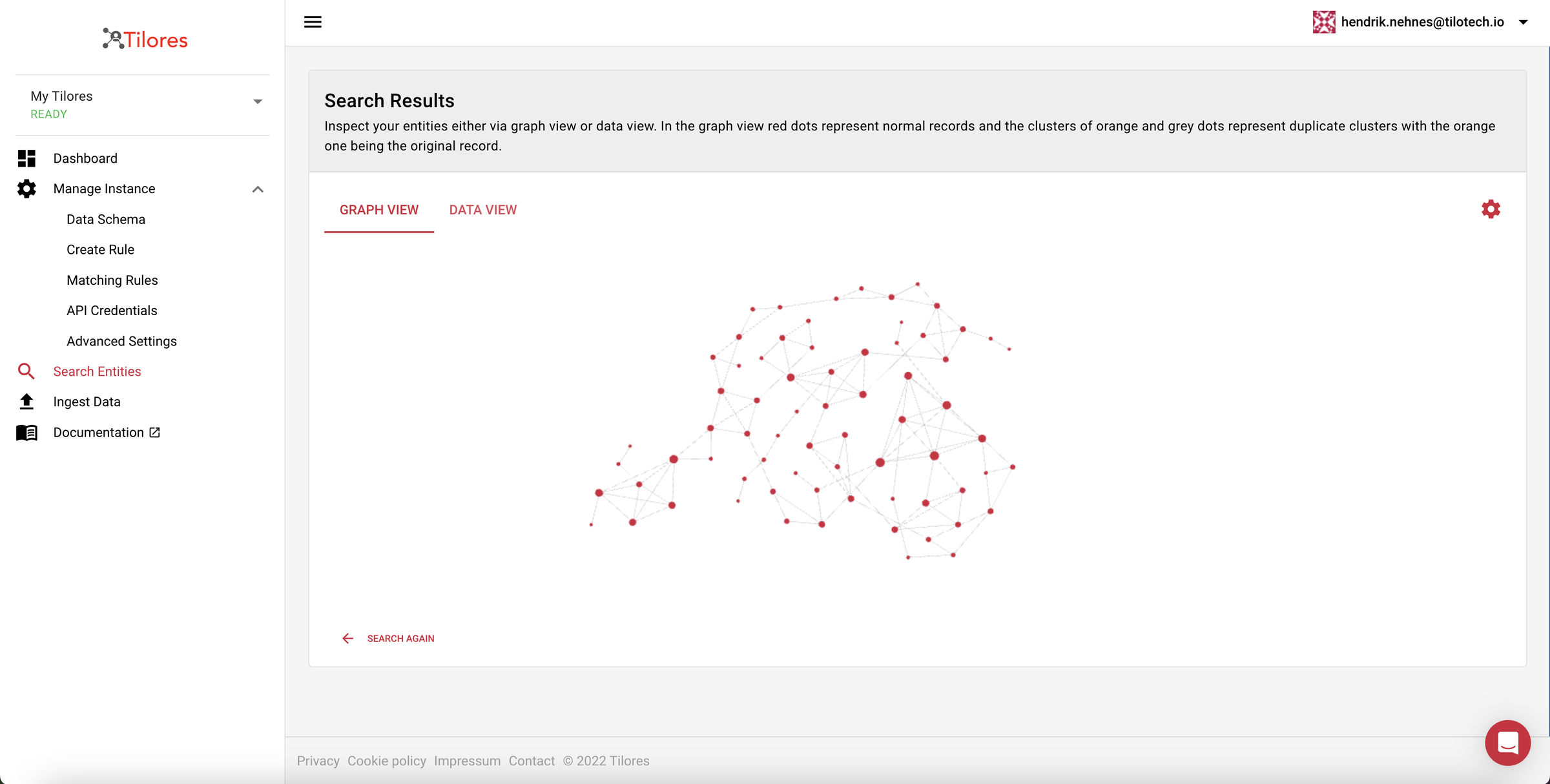

Configure and test your customer deduplication and linking rules in our intuitive UI.

Data infrastructure identity resolution software case study

How TiloRes Enabled a Consumer Credit Bureau to Provide Real-time Data for Fraud Prevention using Identity Resolution Software